As a rule of the financial landscape of 2025, time savings are secondary to accuracy, improving workstreams, and getting more innovative tools into the hands of accountants. AI-enhanced finance tools enhance automation capabilities, simplify repetitive processes, and increase compliance capabilities and actionable insights for businesses.

This article examines the top 10 AI financial automation tools, detailing their unique features and providing actionable advice on integrating these tools well into accounting workflows.

Why are AI Financial Automation Tools Needed for 2025?

Accounting processes have become more complex, and businesses operate in a digital-first environment. Manual accounting systems no longer suffice to do the job at the speed and accuracy required. Here is why AI financial automation tools are a must:

- Improved accuracy: AI eliminates human error while handling intricate functions such as taxes, reconciliation, and information input.

- Time-Saving Features: Tasks that used to take hours, like generating an invoice or reconciling accounts, now take a few minutes.

- Made easy: compliance. Automated reminders and built-in regulatory checks guarantee regularity about tax laws and other financial regulations.

- Improved Decision-Making: Real-time analytics and forecasting enable businesses to grasp risks and opportunities quickly.

- Cost Effectiveness: The company saves dollars on labor and overhead operations costs.

These tools help an individual entrepreneur or an enterprise accountant gain the upper hand in this rapidly changing environment.

The Top 10 AI Financial Automation Tools

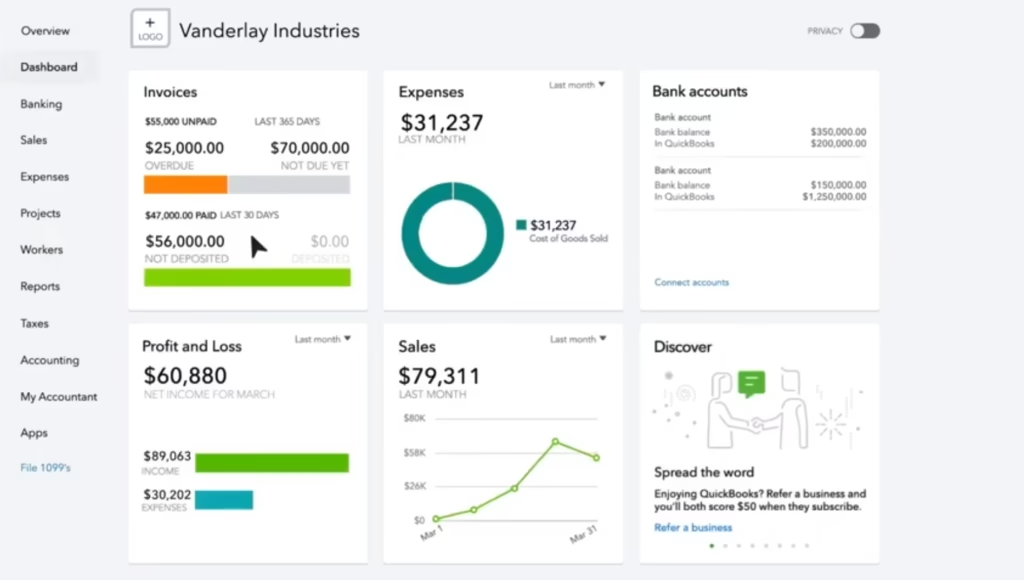

1. QuickBooks Online Advanced

QuickBooks is the most recognized brand accounting software, with some serious AI backup to take the struggle work out of bookkeeping.

Key Features:

- AI-based invoice matching and categorization.

- Predictive analytics for managing cash flow.

- Automation of settlements of finance accounts.

What makes it unique:

- QuickBooks streamlines the entire complicated process of accounting workflows, efficiently working together with other applications like CRM.

- Best for: Small to medium-sized businesses looking for scalable solutions.

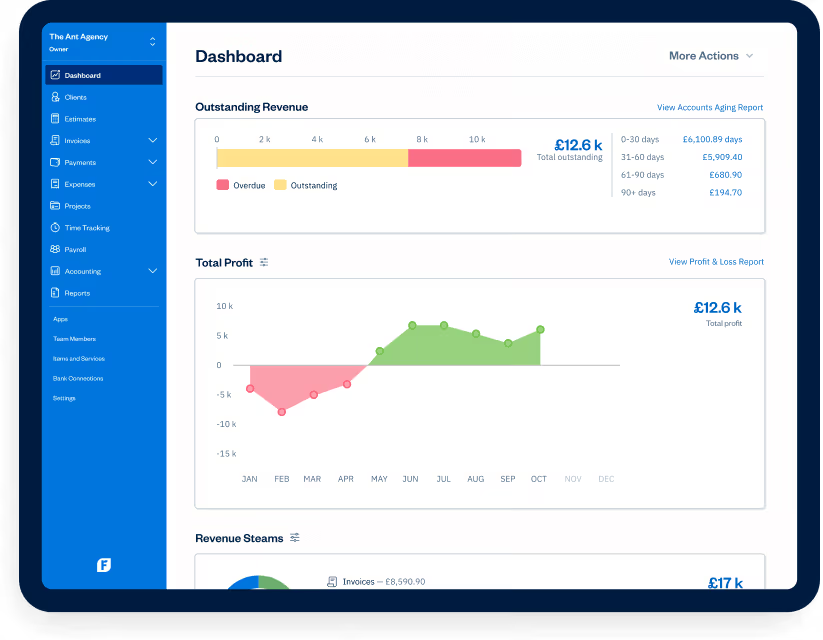

2. FreshBooks

FreshBooks has more intuitive tools that enable small businesses and freelancers to invoice and manage expenses.

Key Features:

- AI-generated financial reports for better visibility.

- Automated scanning and categorization of receipts.

- Sending reminders about bill payments.

Why It Stands Out:

It offers customizable invoicing templates and straightforward reporting, making it great for professionals without a finance background.

Suitable for freelancers and small-scale businesses dealing with client-based projects.

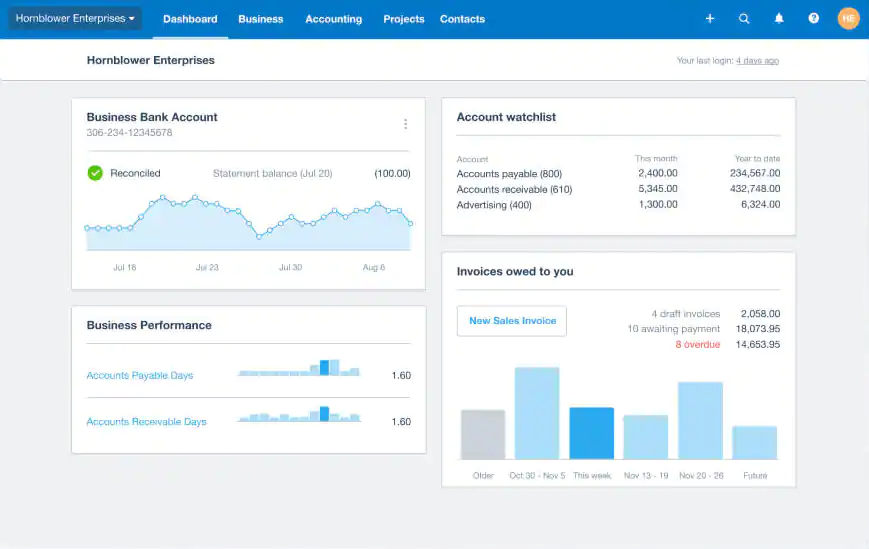

3. Xero

Xero is a cloud accounting application that uses AI to provide more competent financial insight and automate payroll or tax filing processes.

Main characteristics:

- Bank feeds with auto-matched transactions.

- Real-time updates on financial performance.

- AI-powered payroll and compliance tools.

It stands out because:

- These powerful reporting capabilities keep accountants up-to-date with complex financial information.

- Suitable for automation and growth start-ups and small businesses.

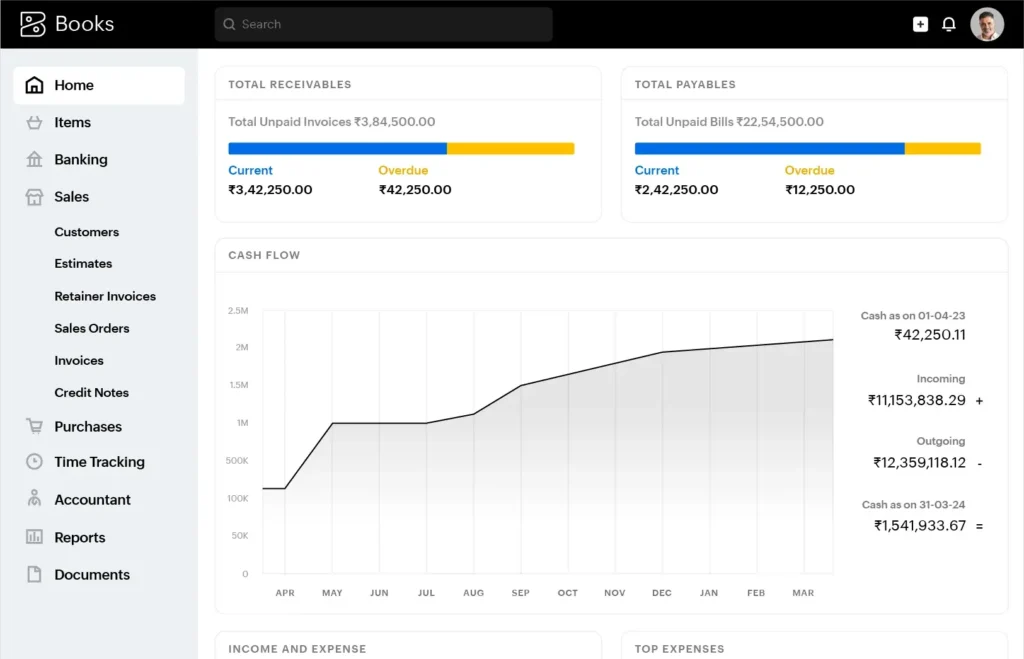

4. Zoho Books

Zoho Books is a comprehensive AI-driven accounting platform that simplifies everything from tax filing to expense tracking.

Major Attributes:

- Real-time tax compliance monitoring.

- Artificial intelligence-based invoice processing and expense management.

- Integration with the Zoho applications.

Why It Stands Out:

It is very budget-friendly but offers enterprise-grade features, is accessible to small businesses, and is excellent for complex accounting.

Best For: Small businesses looking for affordable automation.

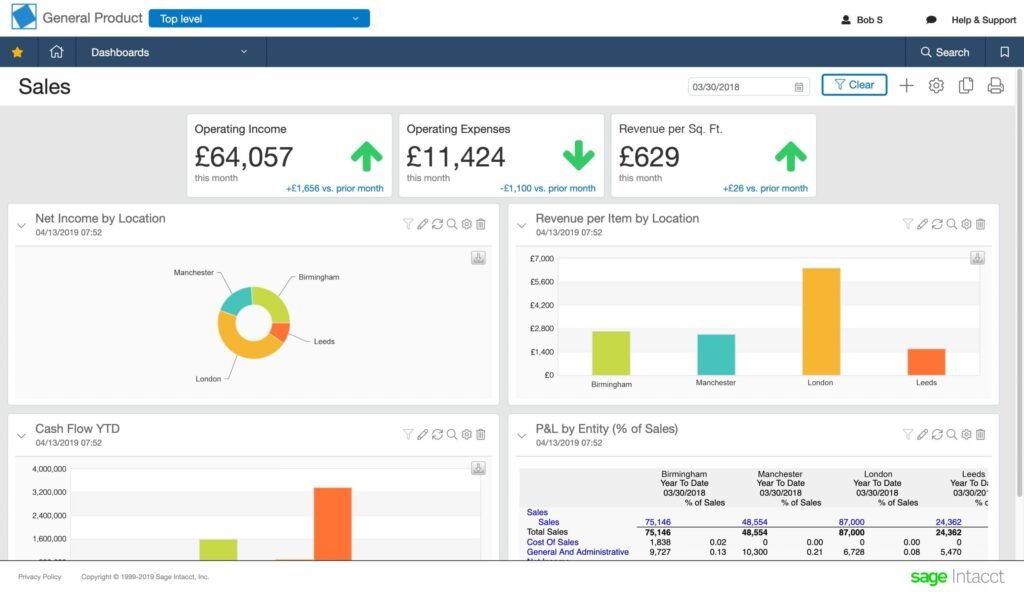

5. Sage Intacct

Enterprise Accounting- Sage Intacct is good at offering some great AI-enhancing options and superior financial management.

Important Features:

- Automated compliance-oriented heuristic-like revenue recognition.

- Multi-entities consolidation financial.

- AI-driven performance metrics and dashboards.

What makes it unique:

It is designed for those complex business environments that require high compliance.

Best For: Large organizations managing multi-entity financial structures.

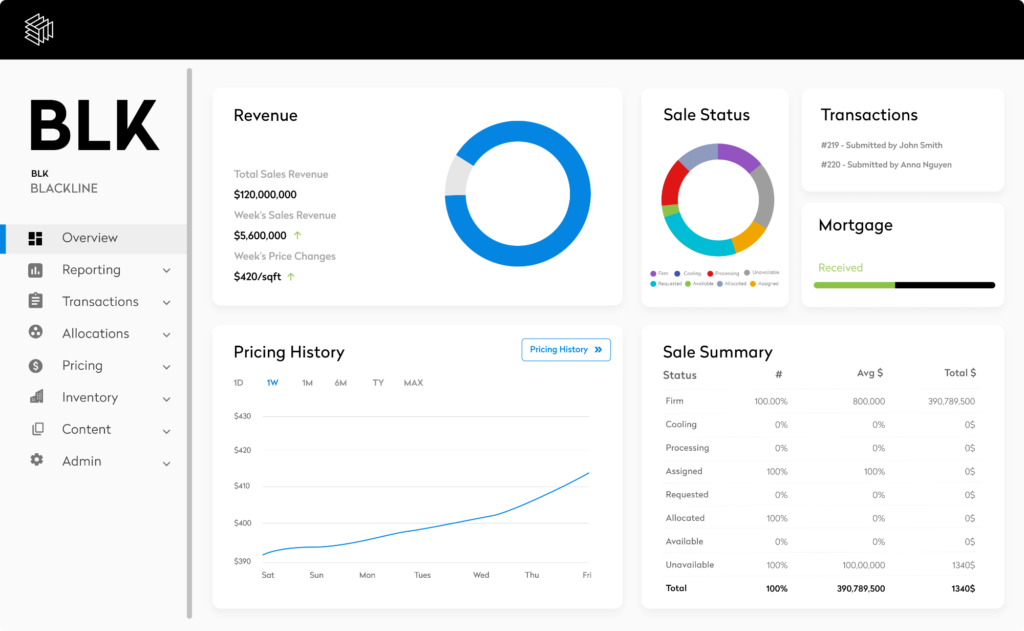

6. BlackLine

BlackLine automates financial close for the most accurate reconciliations in the shortest time possible.

Main Features:

- AI-recommended journal entry suggestions.

- Real-time variance analysis.

- Continuous checking for discrepancies.

Why It Stands Out:

It reduces month-end close times significantly so that businesses can stay audit-ready.

Best for enterprises managing large-scale financial data.

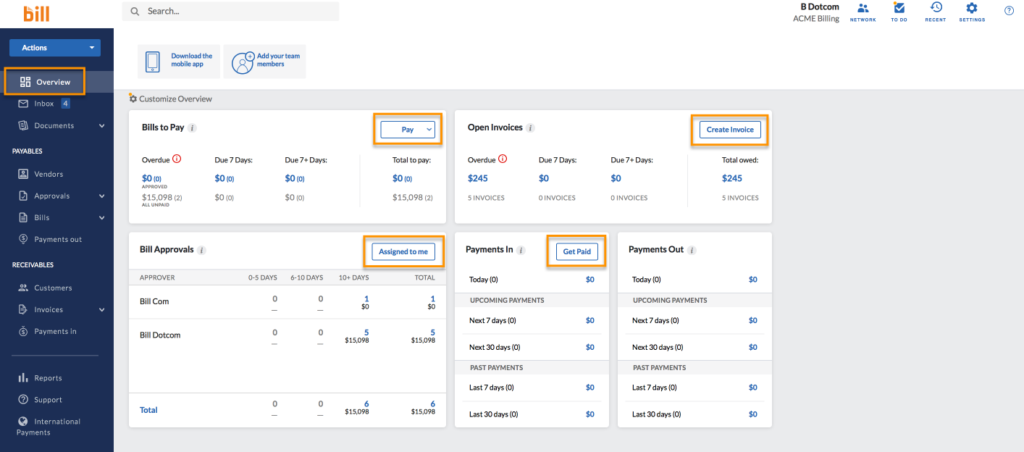

7. Bill.com

Bill.com specializes in simplifying accounts payable and receivable operations with state-of-the-art AI.

Key Features:

- AI-based automated invoice processing and automated approval routing.

- Scheduling and tracking of auto-payment.

- Real-time cash flow forecasting.

Something that stands out:

Integration with major accounting software makes Bill.com necessary for businesses that process vast volumes of transactions.

Best for businesses prioritizing payment and invoice management.

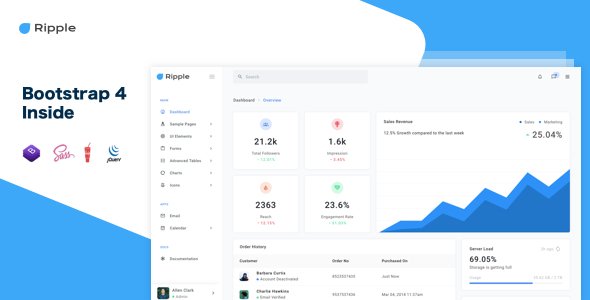

8. Ripple

Wave is free accounting for freelancers and minor business concerns but with low-grade AI features.

Key Features:

- Transactions becoming AI-driven categorized.

- Receipt scanning and invoicing.

- Basic financial reporting.

It is notable for:

Wave’s free features make it an excellent entry-level tool for sole proprietors.

Best for small freelancers or micro businesses with straightforward accounting needs.

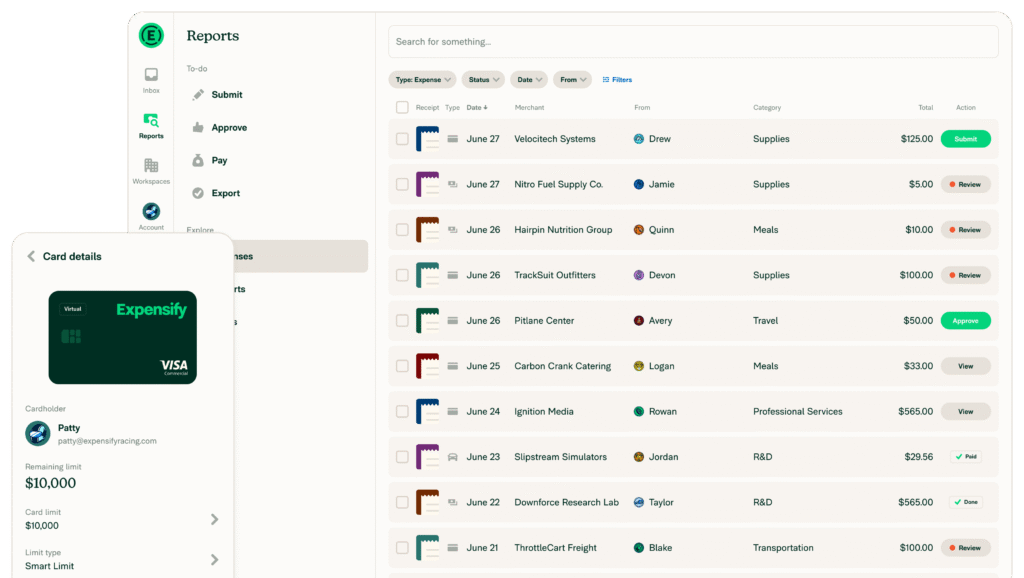

9. Expensify

Expensify shines on automated expense reporting and reimbursement.

Key Features:

- AI-powered receipt scanning.

- This would auto-enforce the policy on expenses.

- One-click reimbursement workflows.

What Makes it Special:

Expensify is great for companies whose workers travel rather frequently for business.

It is best for teams that have significant travel and expense accounts.

10. OneUp

This software, powered by AI, integrates accounting and inventory management for more thoughtful decisions.

Key Characteristics:

- Cash Flow AI Insights.

- Automated bank reconciliation.

- Real-time inventory tracking.

What makes it remarkable:

Its inventory feature makes it a darling among retail and manufacturing businesses.

Best For: Small businesses with inventory needs.

How to Choose the Best AI Financial Automation Tool?

- Define Your Goals: For instance, define your pain points about accounting, such as invoice processing, reconciliation, or compliance.

- Evaluate Features: Pay attention to the tools that provide the most relevant features for your business, such as tax automation or cash flow forecasting.

- Check Scalability: Choose tools that grow with your business and can handle increasing complexities.

- Test Usability: The interface should be usable for accountants and non-financial team members.

- Ensure Integration: It must integrate well with the existing technology stack.

Case Studies in Transforming Accounting with AI

Case Study 1: Retail Business

Challenge: Process volume of invoices manually, resulting in errors and postponements.

Solution: Integrate Bill.com into the processes to automate billing and payment.

Result: Processed payment immediately reduced by 50% and minimized errors.

Case Study 2: Freelance Agency

Challenge: Irregular payments disrupted cash flow.

Solution: Adopted FreshBooks for automated reminders and tracking.

Result: On-time payment increased by 30%.

Case Study 3: Manufacturing Company

Challenge: Difficulty in handling multi-entity financial data.

Implemented centralized financial reporting on Sage Intacct.

Result: Consolidations streamlined and compliance improved.

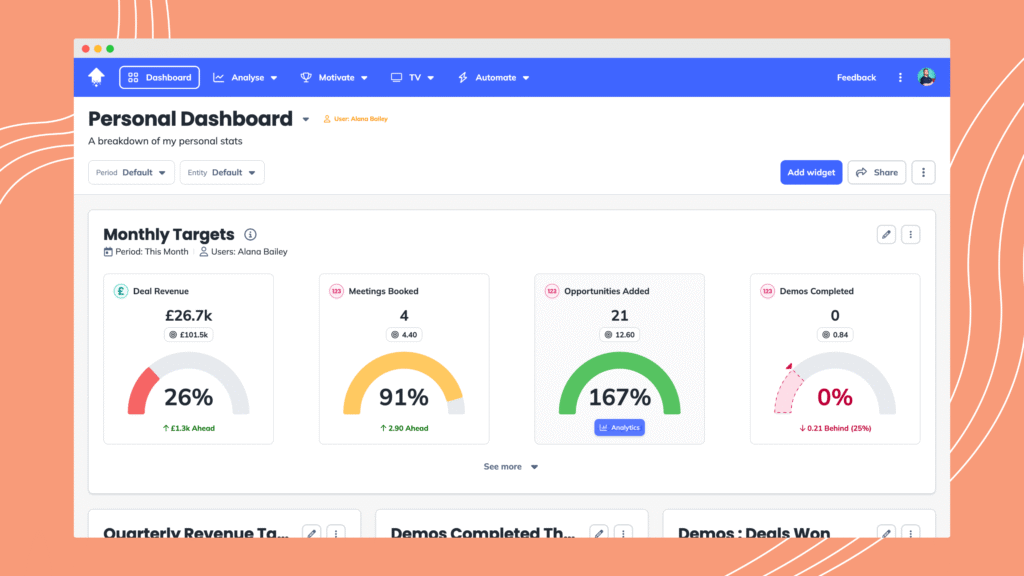

Emerging Trends in AI Financial Tools

- Real-time financial insights: AI tools now offer live dashboards for instant visibility into business finances.

- Voice-Assisted Accounting: Hands-Free Commands Make Complex Jobs Manageable.

- Blockchain Integration: A highly secure framework for transactions.

- Sustainability metrics: AI tools now track environmental costs along with financial metrics.

FAQs about AI Financial Automation Tools

What are AI-based tools for financial automation?

Automated financial tools, such as billing, reconciliation, and compliance using AI.

So, are they good for small business?

Some are designed for small businesses, such as Wave and Zoho Books.

Do they need technical knowledge?

Most tools are user-friendly, requiring little technical knowledge.

Can they be integrated with existing applications?

Most tools integrate seamlessly with CRMs, ERPs, and other accounting software.

How do I start applying these tools?

Plan a small pilot, train your team at that scale, and scale upwards.

Conclusion

AI financial automation tools make accounting easier with minimal error-prone data, providing actionable information to improve decision-making. From freelancers to enterprises, there is undoubtedly a tool that will get the job done. Ready to rewire your accounting process?

Connect with the experts to discover custom solutions and the best AI financial tools for your business. Indeed, more competent accounting turns the doorkey!

TechQwaz is your go-to platform for the latest insights on technology, innovation, and personal branding. Learn more about our mission on our About Us page, or reach out to us through our Contact page. Stay connected and updated by following us on Instagram, Twitter (X), and explore more valuable content on our Blogspot. Keep exploring, keep growing!